Understanding the Key Components of Estate Planning

Navigating Estate Planning

Estate planning is a multifaceted process that often involves a diverse team of professionals. This team may consist of an estate planning lawyer, a financial advisor, and an income tax accountant. The ultimate goal of this collective effort is to address two prime concerns: providing for potential incapacity and death.

Addressing Incapacity Through Planning

Lifetime planning for incapacity primarily involves the use of powers of attorney and living trusts. It’s vital to plan for not only your potential incapacity but also that of your spouse or children. Having health care documents such as medical power of attorney and directives to physicians are indispensable for peace of mind. Property powers of attorney can also be beneficial, albeit with certain exceptions.

The Importance of Death Planning

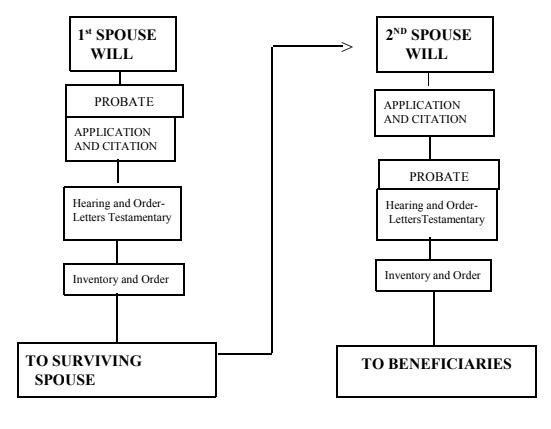

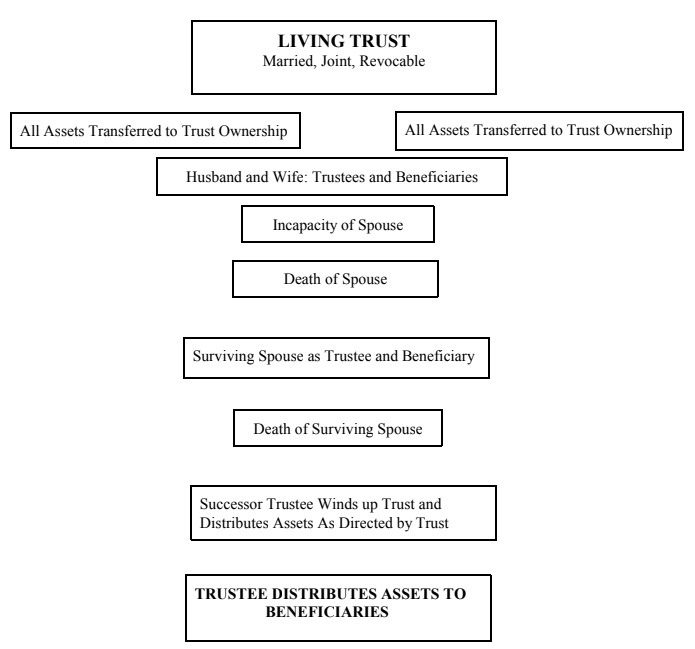

The lack of a death plan can result in intestacy, which can lead to a court-supervised administration—an expensive and potentially lengthy process. Estate planning strategies such as living trusts and wills help to avoid this. While both vehicles ultimately achieve the same goal, the use of a will requires court action after death to be effective, whereas living trusts offer a more private and court-free solution.

Assets Exempt from Probate

Not all assets go through the probate process. Life insurance, annuities, and retirement plan benefits, for example, are typically governed by their individual contracts, not a will. Retirement accounts and other tax-favored funds can also be efficiently distributed to the ultimate beneficiaries through a living trust, making this an ideal alternative to probate through a will.

The Power of Clarity and Protection in Asset Transfers

Clarity of expression is the key to successful transfer of assets upon death, whether through a will or a living trust. Immature children—whether by age or judgment—can be safeguarded from squandering assets through the use of trusts. These provide a shield for the assets from poor judgment while ensuring financial security for the beneficiary.

The Advantages of Living Trusts

Living trusts offer a way to control assets upon incapacity and for distributing assets at death because they are private and don’t depend on probate court approval. They also allow for the continued management of assets upon incapacity.

Estate Tax Planning and the Current Landscape

Both living trusts and wills can include provisions for estate tax planning. However, with the basic estate tax exclusion now at $12.92 million, most individuals do not require estate tax avoidance provisions in their plans.

Understanding the Gift Tax

Each calendar year, a person may give to as many non-charitable donees as much as the current annual exclusion amount ($17,001 for the current year) before a US gift tax return is required. No gift tax is payable unless the aggregate of all gifts exceeding the annual exclusion surpasses the basic exclusion amount of $12.92 million. It is important to note that these exemptions could be subject to change as the tax landscape evolves.

A Cost Comparison: Wills and Probate vs. Trusts

To put things into perspective, the expense of estate planning with two wills and two probates is typically at least 33% greater than that of a joint married trust. Therefore, trusts often provide a more cost-effective solution for married couples.